Clinicians, Imagine Loving Your Life AND Your Finances—Starting Today

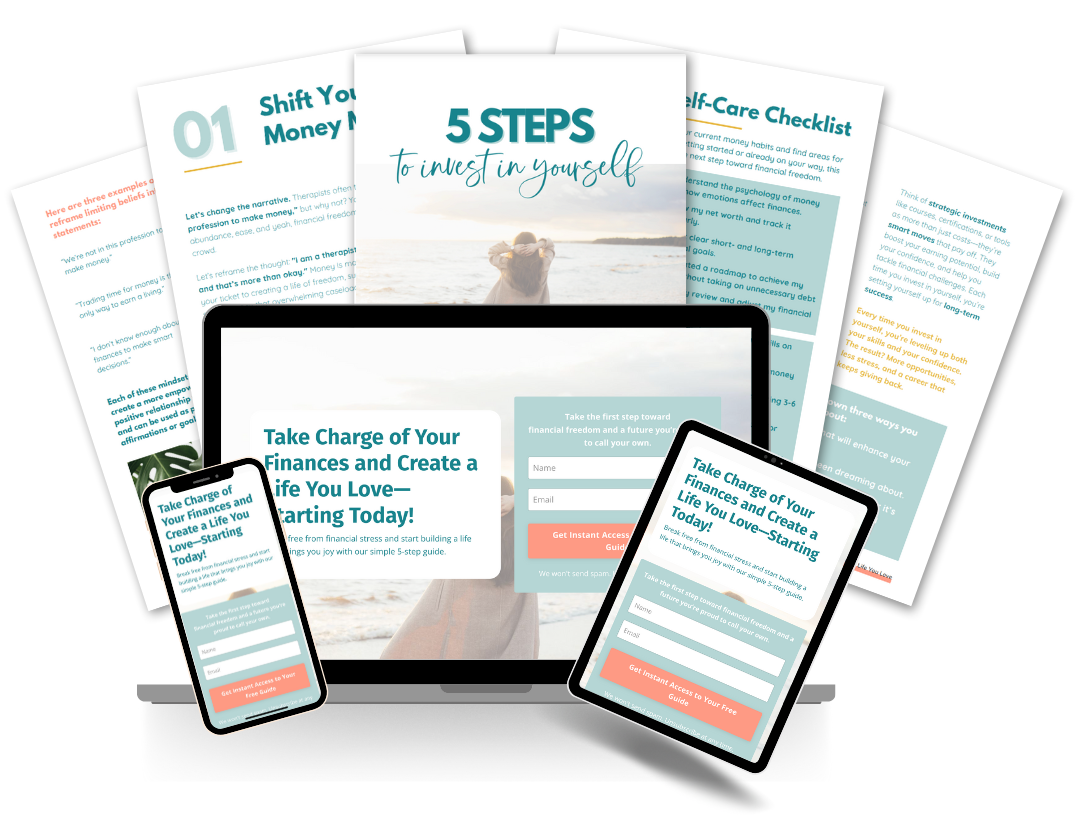

A free, step-by-step guide for SLPs, OTs, and all clinicians to ditch financial stress and create a brighter, more balanced future you’ll love.

Take the first step toward financial freedom and build a future that feels truly yours.

We respect your privacy. Unsubscribe at any time.

Imagine Checking Your Bank Account and Feeling Calm—Not Stressed

Picture this: You wake up, pour your coffee, and open your bank app. Instead of anxiety, you feel confident. Every dollar has a purpose, every bill is covered, and you know exactly how your finances are working for you.

Sound impossible? It’s not—especially with a simple roadmap to get you started.

Clinicians, Let's Rewrite Your Financial Story

For too long, we’ve been told that financial freedom is only for people in different careers, with higher salaries, or “more time.” But here’s the truth: as SLPs, OTs, and clinicians, we have the ability to build a brighter, more balanced financial future.

You don’t need a finance degree or a fancy investment portfolio to get started. You just need clear steps tailored to your life.

That’s where my free guide comes in.

5 Steps to Invest in Yourself will show you how to:

- Break Free from Financial Stress: Tackle those student loans, Target splurges, and endless CEU fees without guilt.

- Create a Plan for Growth: Whether it’s saving for retirement, paying off debt, or building a safety net, this guide gives you easy-to-follow steps that actually work.

- Reclaim Your Time, Energy, and Peace: Let’s make financial freedom something you feel in your everyday life—from fewer sleepless nights to more time doing what you love.

Plus, you’ll get a bonus Financial Self-Care Checklist—a quick and powerful tool to help you figure out exactly where you stand with your financial literacy and where to focus first.

Hey, I'm Kristen.

I’m an SLP, Private Practice Owner, and Financial Coach, and I help clinicians like you go from financial overwhelm to total confidence.

I’ve been where you are—juggling a career, running a private practice, raising three kids, and trying to figure out how to make my finances work for me instead of feeling stuck in the cycle of stress and uncertainty. I’ve had my fair share of financial challenges, from feeling stretched too thin to wondering how to make my income actually support my goals.

Through trial, error, and a whole lot of learning, I built a system that changed everything. These practical, step-by-step strategies helped me take control of my finances, grow my confidence, and create the life I actually wanted.

And now? I’m here to help you do the same. If I can do it, so can you.

What's Inside This Free Guide?

This isn’t just a few bullet points or a generic checklist—it’s a comprehensive, 18-page step-by-step guide designed to help busy clinicians like you take control of your finances.

Here's what you'll discover:

-

Step 1: Shift Your Financial Mindset

Learn how to identify and reframe the limiting beliefs that are holding you back. Because your financial story starts with your mindset. -

Step 2: Heal Your Relationship with Wealth

Say goodbye to the guilt of spending or saving “wrong.” I’ll show you how to align your finances with your personal values so you can make confident decisions. -

Step 3: Set Boundaries with Work and Finances

Overworked and underpaid? I’ll teach you how to set boundaries that honor your time and energy while maximizing your income. -

Step 4: Invest in Yourself

From creating additional income streams to smart savings strategies, discover how to prioritize your goals while still living your life. -

Step 5: Build Your Roadmap to Financial Freedom

Get crystal clear on your financial priorities and create an actionable plan to help you get there—whether it’s paying off debt, saving for a home, or taking that dream family vacation.

And to make it even easier, your guide comes with a bonus Financial Self-Care Checklist. This checklist is designed to help you identify your strengths, areas for growth, and the first steps you need to take. It’s the perfect starting point for your journey.

Kristen has done an amazing job bringing her clinical passion to a new topic I tend to run away from. Her energy and encouraging messages have truly shifted my perspective on the financial aspects of my therapy practice!

Rebecca B., MS, OT/R

This guide is full of thoughtful prompts and practical exercises that really make you reflect! It’s such a helpful resource for anyone looking to improve their financial literacy.

Morgan V., MCD, CCC-SLP

This woman-owned course is a game-changer for SLPs, OTs, and solo practitioners. It's practical, easy to understand, and packed with actionable advice for tackling the unique financial challenges of healthcare providers.

Nancy S., Financial Planner

Why This Isn't Just "Another Guide"

This isn’t about quick fixes or complicated spreadsheets. It’s about giving you the tools to start small, take control, and build the financial future you deserve.

Imagine being able to:

- Spend guilt-free on things you love, like family vacations, quality time, or the hobbies you’ve been putting off.

- Feel confident about paying for CEUs, kids’ expenses, or unexpected emergencies without panic.

- Actually see your finances growing, step by step, toward the life you want.

Your Financial Self-Care Checklist bonus is the key to figuring out where you are now and how to grow. Combined with the actionable steps in the guide, it’s everything you need to feel in control of your finances.